georgia ad valorem tax refund

Married individuals who file joint returns could receive a maximum refund of 500. The two changes that apply to most vehicle transactions are.

Form Pt 50p Download Fillable Pdf Or Fill Online Tangible Personal Property Tax Return And Schedules Georgia United States Templateroller

Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides.

. Single filers and married individuals who file separately could receive a maximum refund of 250. Quick Links Georgia Tax Center. Some of the taxes levied may not be collected for various reasons assessment errors insolvency bankruptcy etc.

Please refer to Form MV-7L to calculate the TAVT on leased vehicles. ETR exceptions must be accompanied by a Title Ad Valorem Tax TAVT return Form MV-7D. Accordingly the fair market value for a used motor vehicle for purposes of TAVT will generally be the same as the value that was used in the old annual ad valorem tax system.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. Information on Georgia tax refunds for corporate individual motor fuel sales and use and withholding taxes. TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance.

NEW effective January 1 2022 - MV-7D - State and Local Title Ad Valorem Tax Fees 28234 KB. How to Request a Withholding Tax Refundpdf. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020.

Complete the File your claim information under Refund Information then click Next. It depends on your filing status. Check your refund online does not require a login Sign up for Georgia Tax Center GTC account.

Using the IRS requirements Georgia will permit paid preparers to sign original returns amended returns or requests for filing extensions by rubber stamp mechanical device such as signature pen or computer software program. A reduction is made for the trade-in. GTC provides online access and can send notifications such as when a refund has been issued.

Review the Refund Request Summary then click Submit. Related Agency Department of Revenue. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those.

If a vehicle is used for business the title tax should be added to the cost basis like a sales tax. Georgia Tax Center Help Individual Income Taxes Register New Business. This calculator can estimate the tax due when you buy a vehicle.

Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty. Click Add Attachment if you need to add forms to support your claim. Georgia ad valorem tax refund.

How to Request a Sales Tax Refund_pdf 42023 KB. If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. Head of Household filers could receive a maximum refund of 375.

Effective January 1 2022 this form is to be used by a dealer to show the calculation of the TAVT on the sale of a new or used vehicle only. Use the automated telephone service at 877-423-6711. This tax is based on the value of the vehicle.

The TAVT rate will be lowered to 66 of the fair market value. To make changes click. For vehicles with a date of purchase of March 1 2018 all certificate of title applications submitted by a selling dealer to a county tag office in paper form ie.

This value is calculated by averaging the current wholesale and retail values of the motor vehicle pursuant to OCGA. TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance Customer Service Operations Georgia Trucking Portal Forms X Alcohol Tobacco. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Georgia law does not allow a refund for partial year residents. If a taxpayer discovers they have paid taxes that they believe were illegal or erroneous they may request a refund within 3 years of the date of payment. Request an additional six months to file your Georgia income tax return.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Use Ad Valorem Tax Calculator. The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year.

ST-12 ST-12A ST-12B ST-12 Claim for Refund 27479 KB ST-12A Waiver of Vendors Rights 53964 KB ST-12B Affidavit for Purchasers Claim for Tax Refund 44397 KB. You will now pay this one-time title fee when registering your car. If you said Yes to Direct Deposit complete the Direct Deposit Information.

Ad valorem taxes are due each year on all vehicles whether they are operational or not even if the tag or registration renewal is not being applied for. The following documentation provides information on how to request a sales tax refund via the Georgia Tax Center. Also refer to Regulation 560-3-2-27 Signature Requirements for Tax Returns.

How to Request a Withholding Tax Refundpdf 32712 KB Taxes. Ad Valorem Vehicle Taxes. The property taxes levied means the taxes charged against taxable property in this state.

Related Topics Ad Valorem Vehicle Taxes. These forms are for claims for refunds of sales tax use tax 911 Prepaid Wireless Charges State Hotel-Motel Fees and Transportation Services Tax.

Carroll County Board Of Tax Assessors

Georgia Motor Vehicle Ad Valorem Assessment Manual

Image Result For U S National Map Of Property Taxes Property Tax American History Timeline Usa Facts

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

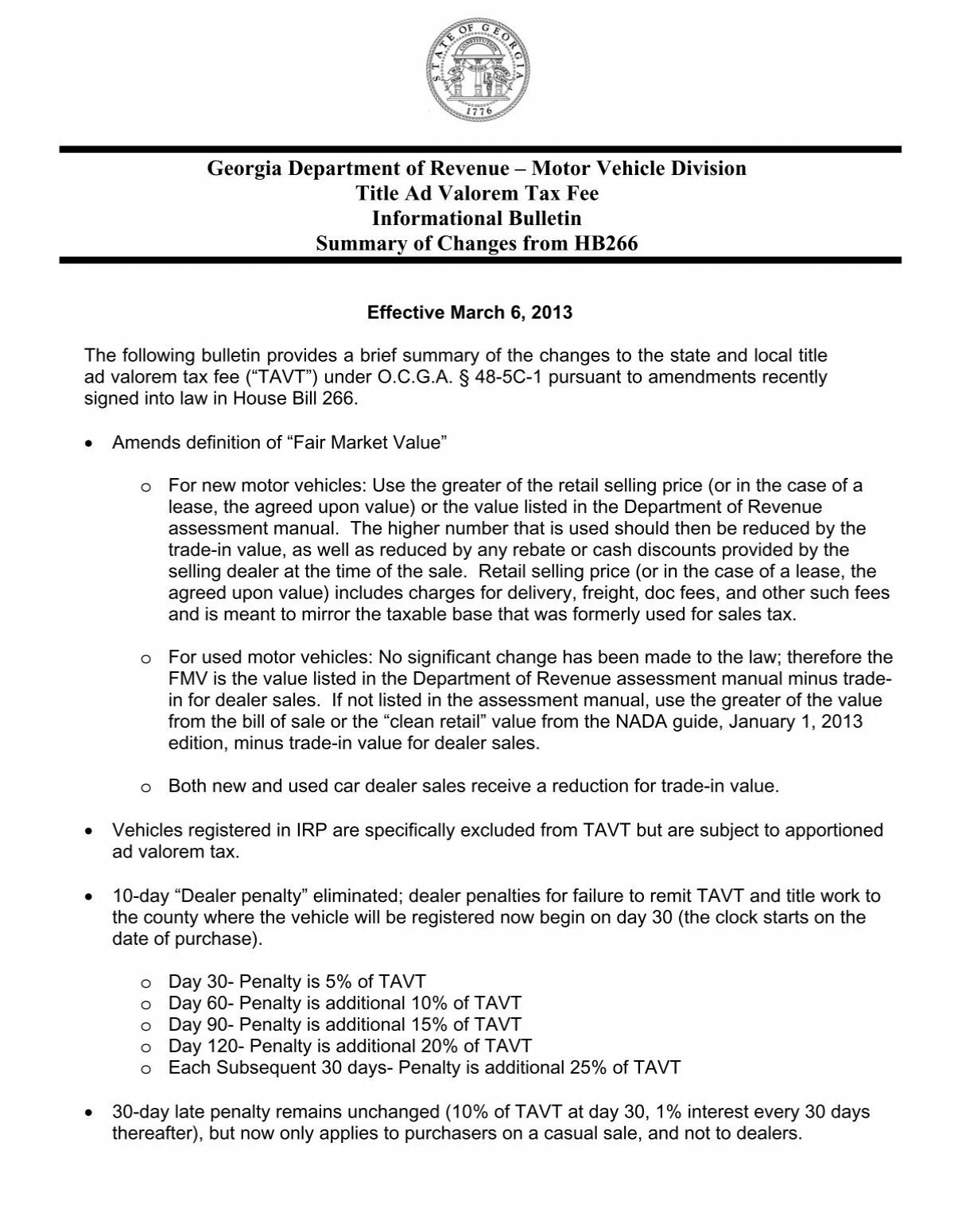

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

2021 Property Tax Bills Sent Out Cobb County Georgia

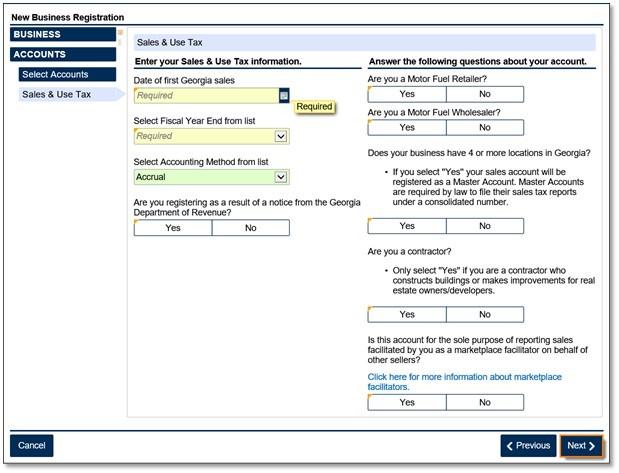

Marketplace Facilitators Georgia Department Of Revenue

Understanding Your Property Tax Bill Suwanee Georgia

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

How To Find A Georgia Employer Identification Number Property Tax Last Will And Testament Tax

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

Property Overview Cobb Tax Cobb County Tax Commissioner

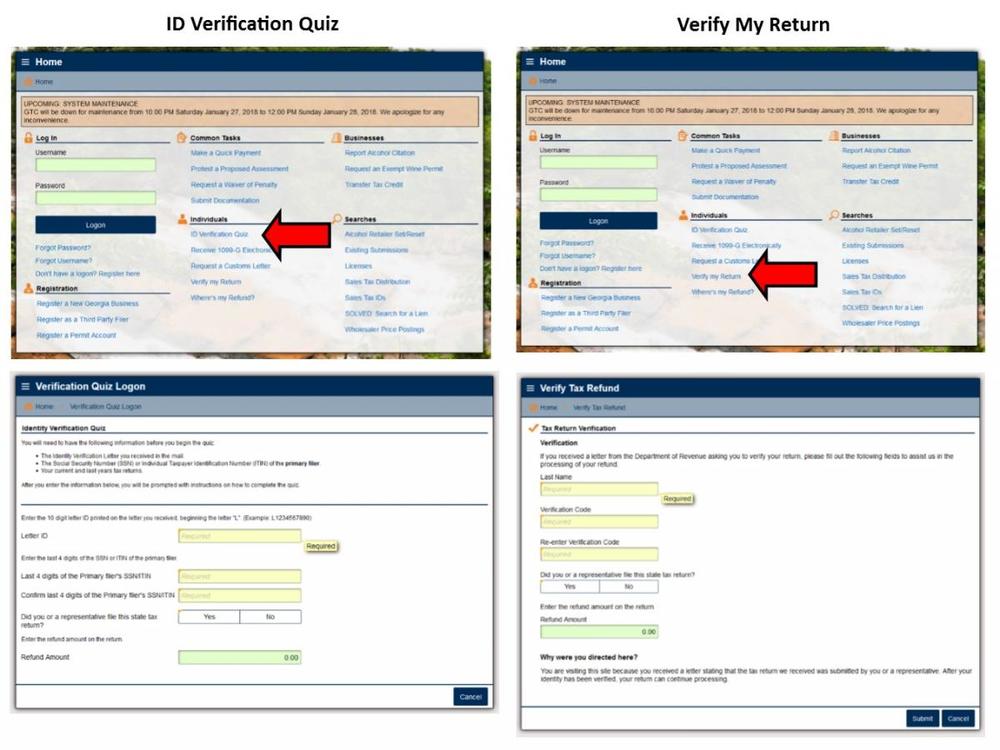

Return Verification Id Verification Quiz Georgia Department Of Revenue

What Are Ad Valorem Taxes Henry County Tax Collector Ga

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute